New Time-saving Tax Reports Now Available on Premium Accounts

Topic: New Features,Taxes | Comments Off on New Time-saving Tax Reports Now Available on Premium Accounts

With the end-of-the-year just days away, taxes are on the minds of many small business owners. Our newest tax reports – Estimated Tax Report and Sales Tax Report – will help you prepare important tax forms and help you plan for next years tax payments.

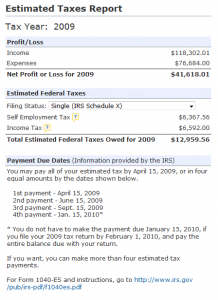

Estimated Tax Report

WorkingPoint’s Estimated Tax Report estimates your federal income and self-employment taxes based on IRS tax schedules for the current year, so you know how much you need to save for end of year taxes or for estimating your taxes for quarterly tax payments.

If you paid additional taxes to the IRS last year over and above your prepayments or withholdings, you’re likely required to pay estimated quarterly income taxes for this year. This means that 4 times a year you pay an estimated amount to the IRS to cover your taxes for the year in advance. You can also choose to pay the estimate for the entire year if you pay it all by April 15. While this can seem like a drag to pay taxes “up front”, it can actually be a help because as sole proprietors, we often forget to plan for our income taxes and then we find out too late that we owe a ton of money in taxes and we don’t have it.

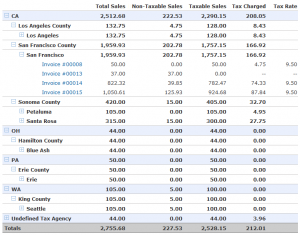

Sales Tax Report

If you charge sales tax for your goods or services, WorkingPoint’s new Sales Tax Report will help you complete the forms required for reporting your sales and tax back to the state. As you invoice your customers, WorkingPoint is tracking where your sales occurred, how much of the total sales were taxable or non-taxable, how much you charged in sales tax and the rates used.

You can use this report to fill out your tax reports and to view complete your sales tax forms as well as view your sales broken down into taxable and non-taxable and your sales total by state, county or city.

These reports are available on our Premium account plan. For more information on account plans, click here.