Estimated Taxes due June 16

Topic: Taxes | Comments Off on Estimated Taxes due June 16

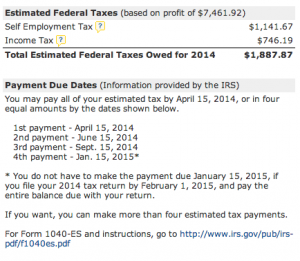

Estimated taxes for the April 1 – May 31 are due June 16.

Use WorkingPoint’s Estimated Tax Report to help you calculate what to pay and report on your IRS Form 1040-ES. The estimated amount it based on the data you already have in WorkingPoint, so if you are new to WorkingPoint, be sure to figure in any sales or expenses not included in your WorkingPoint account. In addition, be sure to subtract out any payments you have already made for the 2014 tax year from the Total Estimated Federal Taxes Owed for 2014 to get an estimate of the balance.

Learn more about the Estimated Tax Report in our online Help Center. The Estimated Tax Report is a premium feature and only available on the Thunderstorm account plan. Not on the Thunderstorm plan? Upgrade today!