Tax Reporting

When you use WorkingPoint to manage your business, preparing your small business taxes is easier than ever. Our tax reports give you the financial data required by state and federal tax agencies in a clear, easy-to-understand format.

WorkingPoint Tax Reporting includes the following reports:

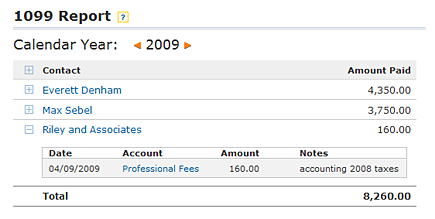

1099 Tax Report

The IRS requires businesses to file information returns to qualified companies and individuals by reporting the money you have paid them for qualifying events during a calendar year using IRS Forms 1099 and 1096. WorkingPoint small business tax software makes it easy to prepare for 1099 tax reporting by making it super easy to flag companies and individuals that you want WorkingPoint to track payments made to. With one-click, you can run a 1099 report and see how much you’ve paid them so you know who to send a 1099 to.

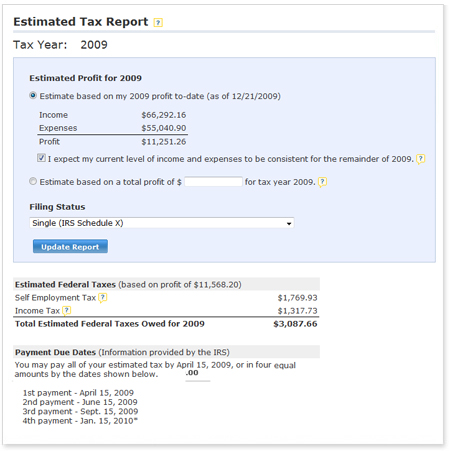

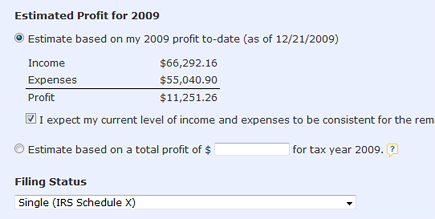

Estimated Tax Report

While it’s no fun to pay taxes upfront, WorkingPoint small business tax software helps you avoid the dreadful, “Surprise! You owe a gazillion dollars in taxes!” when April 15 rolls around by giving you a helping hand in estimating your federal taxes. The Estimated Tax Report includes a calculator that allows you to estimate your taxes for the year based on your own projection for your annual profit or based on the current year’s income and expense activity that you’ve recorded in WorkingPoint.

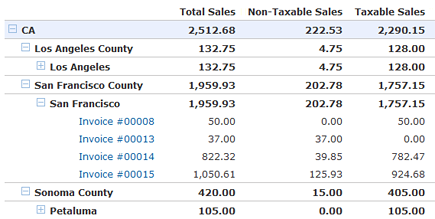

Sales Tax Report

If you charge sales tax for your goods or services, WorkingPoint’s Sales Tax Report will help you complete your sales tax form. As you invoice your customers, WorkingPoint is tracking where your sales occurred, how much of the total sales were taxable or non-taxable, how much you charged in sales tax and the rates used, and reports your sales broken down by state, county and city.

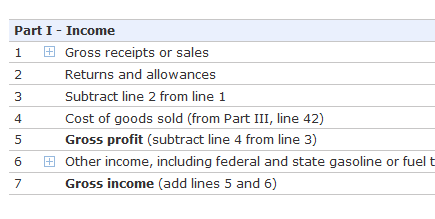

Schedule C Tax Report

If you’re a sole proprietor, you’re required to file an IRS Form Schedule C (along with your personal tax form 1040) to report the profit/loss earned through your business. WorkingPoint helps make filing the Schedule C report easier by letting you assign a particular tax line on the Schedule C form to your accounts. As you record your business activity, WorkingPoint will track the activity by account category for general reporting and by tax line assignment for tax reporting. When tax time rolls around, run the Schedule C report and WorkingPoint will display your activity by tax line, combining like accounts together so you don’t have to.