New to Cash Management?

Learn more about why managing your cash is important to staying in business.

Monitor Cash Inflows and Outflows

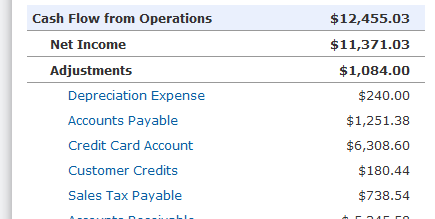

When you use WorkingPoint to manage your business activity you’ll gain insight into the inflow and outflow of your cash. Run a Cash Flow Statement (the most popular cash management report) for a specific time and you can see how your money is being spent and check to be sure you are bringing in more money than you are spending.

Keep an Eye on Your Bank Account Balances

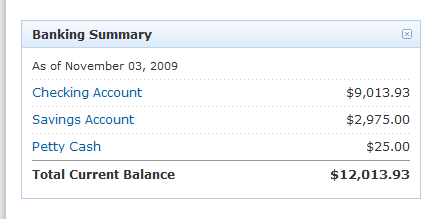

Good cash management starts with knowing how much money you have in the bank. The Banking Summary widget on the WorkingPoint Business Dashboard gives you an at-a-glance view of what you have in your checking, savings, and petty cash accounts.

Manage Your Receivables (What Customers Owe You)

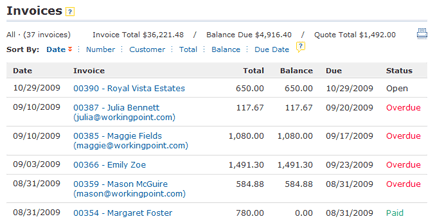

If you extend credit to your customers, WorkingPoint will help you keep on top of your receivables—one of the best predictors of when you can expect an inflow of cash—by tracking how much your customers owe you and when you can expect payment.

Control Cash Outflows

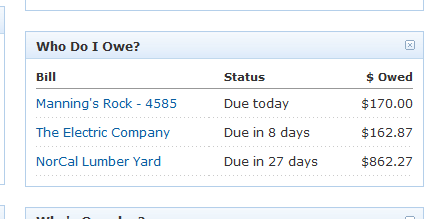

You can’t always predict when money will be coming in, but you can control your money going out. WorkingPoint’s cash management software helps you manage your payables (what you owe your vendors). From the “Who Do I Owe?” widget on the dashboard or by filtering your Bills List to show what is due in the next 7, 30, 60 or 90 days, you’ll know who you owe, how much you owe them and when you should pay them. Combine this with knowing how much money you have on hand and what you expect in, and you’ll know if you can cover the bills or whether you need to hold that check for another week.

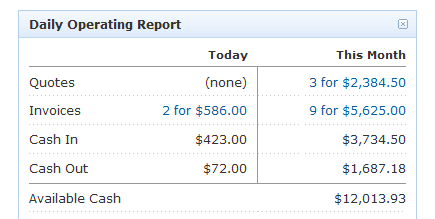

Get Daily Cash Activity Updates

The Daily Operating Report is another handy cash management tool and it’s part of our Premium Reports and Accounting Package. This dashboard widget gives you the low down on your day from both a sales and a cash perspective. It tells you how much cash you have spent today and this month, how much cash you brought in today and this month, how much cash you have total in your bank accounts, how much you owe others and how much others owe you. You get a full look at your cash so you can decide what action to take next, like hold that bill payment or email customers a reminder to send in their payments.