New Premium Feature: Schedule C Report

Topic: Taxes | Comments Off on New Premium Feature: Schedule C Report

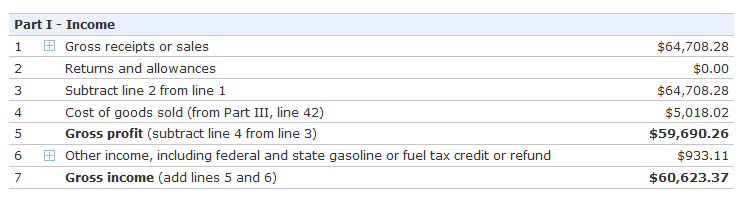

We are pleased to announce our new Schedule C report, just in time to help you prepare the IRS Form Schedule C. If you are a sole proprietor, you are required by the IRS to file the IRS Form Schedule C along with your personal taxes (Form 1040). The IRS Form Schedule C reports the profit/loss earned through your business.

How the Report Works

The report displays your account activity according to the IRS Schedule C tax categories that you select for each of your Revenue, Expense, Cost of Sales,Other Income, and Other Expense accounts. Like the Income Statement, the Schedule C tax form reports the profit or loss earned through your business and these are the accounts types that are used to determine profit.

Categorizing Your Accounts

We’ve gone ahead and assigned a Schedule C reporting category for the pre-defined set of accounts in your default Accounts List but you can change them.

Reviewing and Changing Account Categories

The Accounts List export includes a new column named Schedule C Tax Category. By exporting your Accounts List, you will find the name of the IRS Form Schedule C tax line that has been selected for each applicable account.

To view the selected reporting categories for your accounts, simply go to the Account List and click the Export icon.

If, after reviewing your accounts export, you see some you want to change, just go to the Accounts List, hover over the account and click Edit. Then select the category that best fits your account activity from the Schedule C reporting categories menu. If the account is not tax-related, then you can select “None.”

Changes to Your Accounts

Prior to the release of this report, there was a single expense account in our pre-defined set of accounts for recording Travel, Meals and Entertainment expenses. Because the IRS lets you only deduct 50% of qualifying meals, we have split up the account to match the IRS Form Schedule C.

- If you had not previously made any changes to that account, you will see that it is now a parent account of 2 new accounts: 1) Travel and 2) Meals and Entertainment. To ensure accuracy of the Schedule C report, please use the Meals and Entertainment account to track expenses for meals that qualify for the 50% deduction.

- If you had previously made changes to that account (either by changing the account name, or creating your own child accounts within it) we did not add the new accounts. To ensure accuracy of the Schedule C report, please make sure to map the account you are using to track expenses that qualify for the 50% deduction is mapped to the Schedule C reporting category Travel, meals, and entertainment: Deductible meals and entertainment.

If you have changed the names of other applicable accounts in our pre-defined set of accounts or added your own, we have assigned the “Other” category to the account per Type. For example, if you changed the expense default account “Advertising” to “Marketing & Advertising” then we selected “Other Expense” as the Schedule C category. Please review these assignments and change them as appropriate.

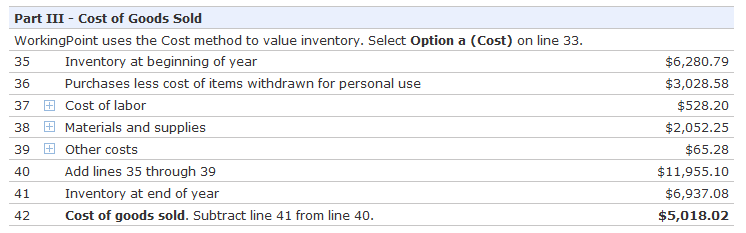

The Cost of Goods Sold Account

When designing the Schedule C report, we took a look at how we were currently handling cost of goods sold. For Schedule C reporting purposes, WorkingPoint reports cost of goods sold for inventory items through reporting the change of inventory, therefore you do not assign a category to the Cost of Goods Sold (COGS) protected account. This means we don’t take the amount recorded in the COGS account and simply add it to the report line. The value for costs associated with inventory is reported by the change in inventory. Because of this, anything you add to the COGS account outside of the intended purpose – tracking COGS from the sales of inventory – will not display in the report. It will still be included on your Income Statement (P&L) but it won’t be included on this report.

To help ensure accuracy of your report, we have limited the use of your COGS account and its availability in the account selector menus. You can still use the cost of goods sold account using the adjusting entry form. But we recommend that you use other cost of sales accounts to track the costs for non-inventory related stuff like labor or things you just don’t want to track because you don’t store it in inventory. If you use another cost of sales account, it will show as part of your total cost of goods sold on the Schedule C report and your Income Statement.

If you have used the Cost of Goods Sold account for transactions other than the system’s recording of the cost at time of sale or inventory adjustments, we recommend that you use the Move Entries feature to move the entries from the Cost of Goods Sold account to another Cost of Sales account so that your costs will be included in your Schedule C report.

For more information on the Schedule C report, please visit our online Help Center.