Managing Your Cash (Part 2) – Keep on Top of Your Collections

Topic: Business Dashboard,Cash Management,Contact Management,How-to,Managing Your Business | Comments Off on Managing Your Cash (Part 2) – Keep on Top of Your Collections

In this week’s Managing Your Cash series, I’m sharing the top 3 things you can do the better manage your cash and how WorkingPoint can help. Monday, I wrote about one of the biggest mistakes business owners make in managing their cash and that is tying up their money in inventory.

Today’s tip: Keep on top of your collections.

Another big mistake small businesses make is not following up on customers who have fallen behind in payments. While Accounts Receivable (what your customers owe you) is considered as asset and your Balance Sheet still looks good – you can’t pay your employees or your bills with an IOU.

The easiest way to keep your cash flowing in is by keeping on top of your customers over due invoices.

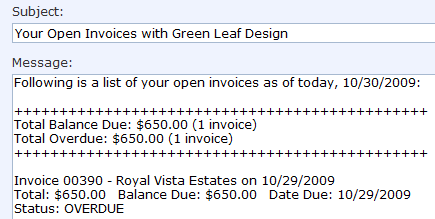

WorkingPoint can help you monitor “Who’s Overdue?” from the dashboard. The “Who’s Overdue?” widget helps you keep on top of customers who are past due so you can take action to collect the money your owed. WorkingPoint will show you who is past due, by how many days they have past the due date and the amount that they owe. Check this widget weekly and then send friendly reminders of your customers account status from their contact record for anyone who shows up on the list.

Sending an invoice list with the current status is a non-emotional way to nudge your customers to pay. If they don’t – call them to see when you can expect payment and work up a schedule of payments if they can’t pay you in full. Follow up the call with a written schedule or payments to help you both recall what you agreed to. If they just don’t pay – consider not selling to them until they bring their account up to date or taking further collections actions.

By keeping on top of your collections with WorkingPoint, you’ll know who’s overdue so you can follow up and get paid.