Inventory Management – How to track your inventory (Part 3)

Topic: Double-entry Bookkeeping,How-to,Inventory Management,Tips & Tricks | Comments Off on Inventory Management – How to track your inventory (Part 3)

In Part 2 of our Inventory Management series, I showed you how easy it is to import your items or start tracking inventory for the items you already have in your WorkingPoint account. And that is a great start to tracking your inventory! To maintain accurate inventory records for costing and valuation, you need to keep on tracking.

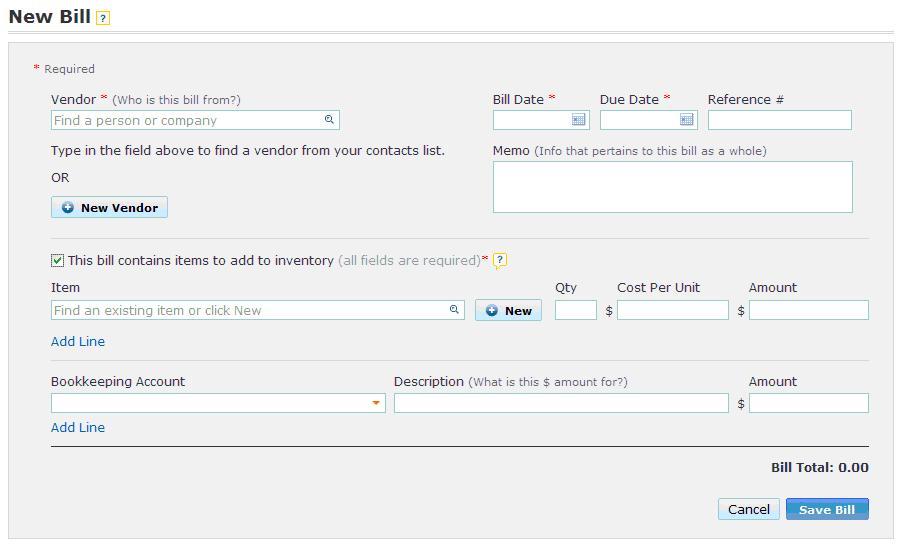

Starting with Bills

Whenever you purchase an item from a vendor and they provide you with a bill to pay them later, use the bill form to record the purchase. You can record non-inventory items, like shipping, in the Bookkeeping Account fields. But when you purchase items you track inventory for, check the “This bill contains items to add to inventory” checkbox. Item fields will appear so you can enter in the item, the cost of the item, and how many you purchased.

Behind the scenes WorkingPoint will manage your inventory: adding the quantity to your Available Quantity and adjusting your Average Cost, if necessary.

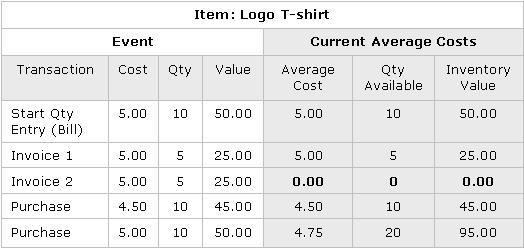

About Average Cost

Average Cost is a method of calculating the value of inventory. When you track inventory for an item you keep in stock, WorkingPoint uses the Inventory Assets account to record how much you paid for item(s) and tracks how many you have available to sell. From the Inventory Asset account, you can see the value of all the items in stock at a glance. You can also find the value of your items on the Balance Sheet report.

The average cost of an item is calculated by dividing the total cost of the items you currently have in stock by the total number of units for sale. WorkingPoint automatically changes the Average Cost based on adjustments and purchase you make for the same item, but at a difference price. You can find the average cost of an item on the item’s detail page and on the Items List.

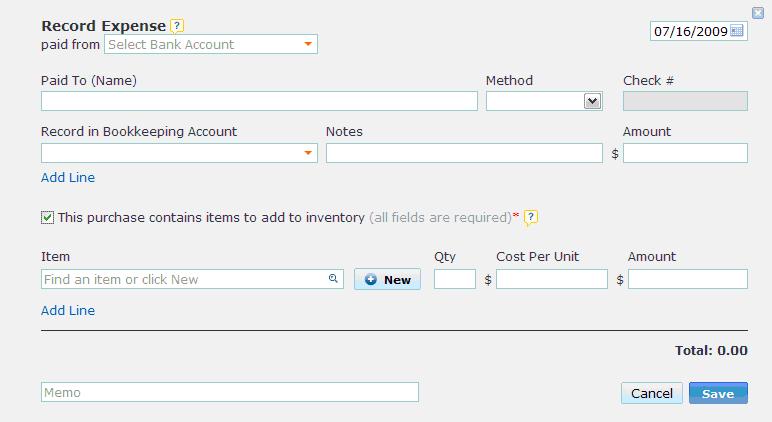

Same Goes When Recording Expenses

When you buy items and pay for them at the same time, you can use the Record Expense form to record your purchase. Check the “This purchase contains items to add to inventory” checkbox and enter in the quantity and cost for each item you want to track the inventory for. WorkingPoint will calculate your new Average Cost and update your Available Quantity accordingly.

On the Flip Side

When you sell your items, be sure to add the item to the invoice and WorkingPoint will reduce the quantity available to account for what you sold. This keeps your inventory counts up-to-date and a couple other things happen now too.

Tracking your Sales

When you set up an item (whether it is inventory tracked or not), you specified how you want to keep track of the sales by selecting a Revenue account from your Accounts List. In this account, WorkingPoint will record the sales of the item. So when you run your Income Statement report, you can see the value of your sales by account.

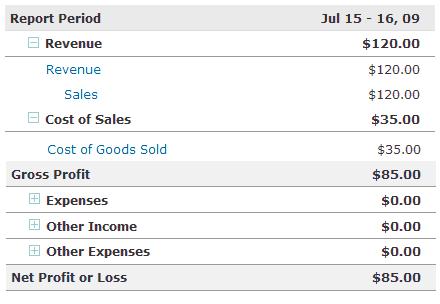

Tracking your Cost of Sales

If the item is inventory tracked, WorkingPoint will also record the cost of sales for the item. WorkingPoint has set up an account for you to track this value: It is called the Cost of Goods Sold (COGS). COGS is a subaccount of Cost of Sales and appears on your Accounts List as Cost of Sales: Cost of Goods Sold. This account keeps track of how much it cost to sell your items and is recorded whenever you sell an inventory-tracked item. The benefits of recording COGS is that when you run an Income Statement, you can see what your actual Gross Profit is, that is –what you really made from your sales after you take into account what it cost you to buy the goods you sold.

Sample Income Statement

Here you can see that this company sold $120.00 worth of goods (Revenue>Sales) and it cost them $35.00 for the goods (Cost of Sales > Cost of Goods Sold). So their Gross Profit is $85.00.

As you record the comings and goings of your items through bills and invoices, WorkingPoint will keep your item records updated. Keeping accurate inventory levels is important to managing your business: you will know the value of the inventory you have on hand, which is important to the IRS; you will know what you have on hand, which is important for managing customer orders and your cash; and knowing your cost of sales is important if you want to know your Gross Profit and if you want to reduce your tax liability, since COGS is deductable.

For more information on working with inventory in WorkingPoint, check out our online Help Center. If you need more help, please shoot me an email at support@workingpoint.com.

Kelli Wall

Content & Support Manager