Income Tax Filing Deadline Fast Approaching

Topic: Taxes | Comments Off on Income Tax Filing Deadline Fast Approaching

April 15th – the deadline for filing income taxes – is just days away. If you haven’t taken advantage of the WorkingPoint’s Schedule C report to help prepare your taxes, you may be doing more work on your taxes than you need to.

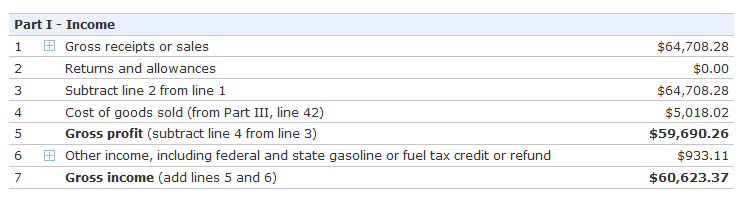

Part 1 of the report shown below.

The report displays your account activity according to the IRS Schedule C tax categories that you select. We have designed our report to mimic the Schedule C report categories and line items so you can see the parts of the report clearly defined, as well as the line item details, including calculations. In each section, WorkingPoint summarizes your account totals for the current tax year according to Schedule C reporting categories. For example, the entries for the current year for all Revenue accounts assigned to the Schedule C Reporting Category: “Gross receipts or sales” are added up and the total is displayed on Part I, line 1.

The Schedule C Report is a available on Premium account plans. For more information on this report, check out our online Help Center.

Need more time to file your return?

You can file a request to extend your filing deadline. If approved, you’ll get a six month extension and have until October 15, 2011 to file your return. To file an extension request, sole proprietors must complete Form 4868, Application for Automatic Extension of Time To File U.S. Income Tax Return and file electronically using E-file or printing the form and mailing it. Corporations and Partnerships are required to file other forms. Your must file your request by April 15.

Note: By filing an extension, you don’t have to file your return by April 15 but if you do not pay the tax due by April 15, you will owe interest and possibly penalties.

For more information on filing an extension, visit the IRS website.