How to Record Personal Expenses Paid with Business $$

Topic: Double-entry Bookkeeping,Tips & Tricks | Comments Off on How to Record Personal Expenses Paid with Business $$

As business owners, we usually pay ourselves last and try to keep as much cash in the business as possible to cover bills and other expenses. So it is real easy to go for the company debit card or credit card first when out shopping for yourself. And as a sole proprietor, that is cool–you can spend as much of your “business” money as you want to on personal stuff–as long as you account for the purchase correctly.

Personal expenses are different from business expenses. Business expenses have a legitimate business purpose and are “ordinary and necessary” for your business or trade, according to the IRS. Personal expenses have no direct relation to the business and cannot be deducted along with business expenses.

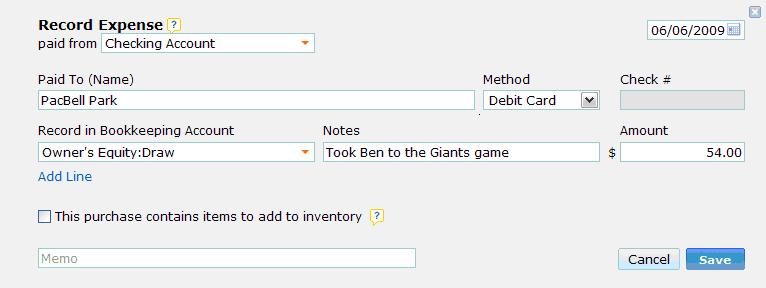

For example, let’s say you used your company debit card to treat your visiting nephew out to a ballgame and dawgs on Saturday afternoon. (Obvious personal expense for the non-sports related businessperson) When you get back to the office on Monday, use the Record Expense form (from the home page click Record Expense, then click Paid from Bank Account) to record the purchase. Complete the form and for the bookkeeping account, select Owner’s Equity:Draw from the list to record the purchase as a personal expense.

The Owner’s Equity:Draw account keeps track of all of the money you take out of the business for personal use. This is the same account you should use when you pay yourself each week or month. By using the draw account, you ensure that the personal expense will not be included in with your business expenses. This is important because “generally, you cannot deduct personal, living, or family expenses.”

It is also important in tracking your equity. WorkingPoint uses your equity accounts on your balance sheet to show your financial position. What you put into the business (your investment) and what you take out (your draw) contribute to the total equity you have in built in your business. So, in the reverse, when you spend your “own” money on business expenses, record the expense and select the bookkeeping account “Owner’s Equity:Investment,” so you can track the money you put into the company.

Next time you are out of cash and you reach for your business cards to pay for that dinner or manicure, go for it. Just be sure to record the expense correctly and take the draw for personal expenses.

For more information on the IRS rules for business expenses, see http://www.irs.gov/businesses/small/article/0,,id=109807,00.html. For step by step instructions on how to record an expense, visit our online Help Center.

The WorkingPoint Team