4 Things to do with your Profit/Loss Statement- Using your Income Statement

Topic: WorkingPoint News | Comments Off on 4 Things to do with your Profit/Loss Statement- Using your Income Statement

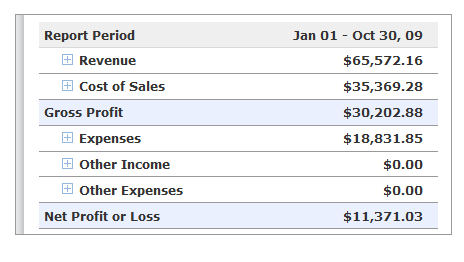

So you set up your WorkingPoint Account. You’ve got your accounting software up and running, and you finally created that free profit and loss statement everyone’s been telling you that you need for your business which is included with your paid subscription to WorkingPoint. Your head is buzzing with words like equity, revenue, expenses…. So what do you do with your profit and loss statement (also known as an Income Statement) now that you’ve made it? Why does everyone tell you that you need one? The following is a list of 4 things you should do with the statement to help you to run your business better:

So you set up your WorkingPoint Account. You’ve got your accounting software up and running, and you finally created that free profit and loss statement everyone’s been telling you that you need for your business which is included with your paid subscription to WorkingPoint. Your head is buzzing with words like equity, revenue, expenses…. So what do you do with your profit and loss statement (also known as an Income Statement) now that you’ve made it? Why does everyone tell you that you need one? The following is a list of 4 things you should do with the statement to help you to run your business better:

1) Look for trends There is more than one way to look at an income statement. Set it up by month, season, even day of the week. Are their any trends? Does high profit correspond to a marketing event? A holiday? A specific product you carry? Being aware of these trends will help you plan accordingly when it comes to inventory/scheduling, and start to think creatively about what those trends mean about your clients and customers. Could you carry over the strategy that generated the bump into less profitable times? Throw additional strategic events? Form some kind of partnership or increase stock with the product line that is doing so well for you? These trends and patterns should drive your business strategy by showing you where you are succeeding, and failing. Put more resources into where you are strongest, and stop wasting them in areas that aren’t working for you. If it’s costing you more than it’s earning you, reconsider that part of your business. Make sure you understand what’s working for you, and what isn’t.

2) Create a budget Look at your spending patterns and then plan accordingly. Step one is identifying the trends. Step two is developing a strategy. Step three is making sure you have the ability to capitalize on that strategy with the funds, inventory and resources you need. Where will you increase spending? Where will you cut to increase spending in the area? How can you cut down on expenses where they aren’t translating into a high ROI? How much should you be spending each year/quarter on things like office supplies, rent, equipment, software, etc? Use your income statement to help your business stay on track and stay profitable.

3) Print out a Copy and send it to your accountant If you have an accountant why not print out a copy of the report in addition to the other tax reports you can generate in WorkingPoint and give that to your accountant to help you when tax season rolls around. The more complete the financial picture your accountant has, the more they will be able to help you!

4) Check it and Update it all the time Stay on top of your business by keeping your financial up to date. You can evaluate the health of your business, and make sure your strategies are on track. As a small business owner, taking the time to “check in” with your income statement will help to keep you focused and on track towards your goal of managing a successful business!