WorkingPoint in the New York Times Small Busines Blog: “A QuickBooks Alternative for the Accounting-Phobic Owner”

Topic: WorkingPoint News | Comments Off on WorkingPoint in the New York Times Small Busines Blog: “A QuickBooks Alternative for the Accounting-Phobic Owner”

Thank You New York Times’ Small Business Blog for your glowing review of our product!

” WorkingPoint was designed as an online accounting system for the accounting-oblivious business owner who’s focused on selling and delivering — and on managing inventory if there is one. When you log on to WorkingPoint for the first time, it walks you through the one process that every business owner knows and even loves: creating an invoice.

I gave it a try — hey, as a self-employed writer I’ve been running a business for a few decades — and ended up with my first computer-generated invoice ever. It took seven minutes, most of which was spent typing in information, like my address, that I wouldn’t have to enter the next time. When the invoice was finished, I was able to pull up my first profit-and-loss statement and my first balance sheet. (I’m in the black! This month, any way.) Although WorkingPoint provides a fairly full set of accounting capabilities, you wouldn’t know it by what you see on the screen. Instead, it looks as if it’s there to help you get your customers to pay you, to pitch new customers with quotes, and to track what is or isn’t going out the door; the accounting happens automatically.”

Our favorite part:

“I also tried several other online small-business accounting systems, and none of them was as easy to set up and start using.

Xero and QuickBooks would initially be slow going and probably anxiety-producing for the bookkeeping clueless, and the array of more advanced capabilities these sites prominently place at your fingertips doesn’t exactly scream, “Welcome, accounting newbie!” FreshBooks is cleaner and easy to use but still doesn’t quite match WorkingPoint when it comes to a truly stripped-down, intimidation-free means for getting organized.“

In the comments section there were also some great questions that we wanted to address, thanks so much for asking such great questions!

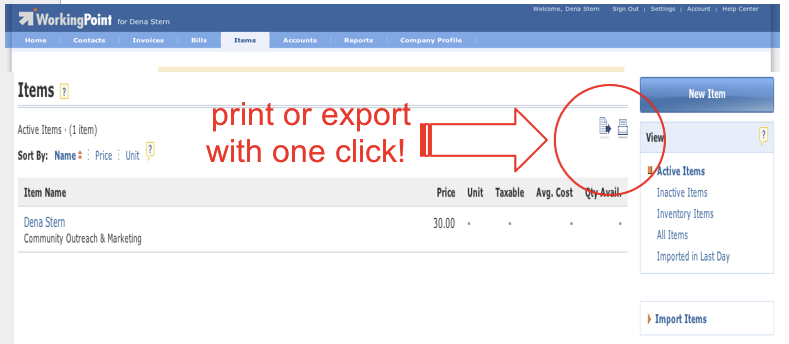

1. What happens if the on line business goes out of business. Where does your companies financial information go? Is there a migration path for how to move your information out once your business gets too big for the “small company” that you run?

If WorkingPoint were to go out of business, or if you were to become a giant company too big for this solution or you just want a CSV version of your data… exporting your data from WorkingPoint is ridiculously easy. You can find instructions on how to do so in our support section. All your data in WorkingPoint can be downloaded just by clicking on the CSV icon which is located next to all of the different types of data (CRM, contact lists, accounts lists….).

2. What is the privacy level of your information?

WorkingPoint has the highest level of internet data security available, the same level of security that your bank has. We have to, we allow you to link your WorkingPoint account to your online banking so you can import transactions with a click of a button!

Your critical business data is far more secure in WorkingPoint than it would be on your own computer. Security has been built into WorkingPoint from the very beginning, and we work continuously to ensure that WorkingPoint remains secure and your data stays safe. You’ll never lose data if your computer crashes. We use Amazon EC2, so our service runs with the proven network infrastructure of the world’s biggest and safest e-commerce company. We use the same internet security technologies that banks do, so your data is bank-grade secure with 128-bit Secure Sockets Layer (SSL) Encryption. Your data is continually and reliably backed up. Plus, your WorkingPoint site is automatically updated with the latest, most secure version – no complicated installs or security patches.

3. How accurate will your information be and how easy is it to correct mistakes? I often see the “simple” accounting packages can get you incorrect information because they don’t require double entry when putting information in. Remember garbage in, garbage out.

WorkingPoint uses Double Entry Bookkeeping.

Double-entry bookkeeping is at the heart of good financial management for any business. It follows a set of standards used by accounting professionals to record businesses activities and interpret business finances. The alternative to the double-entry bookkeeping method is the single-entry method, also known as the checkbook method because it is similar to tracking your business activities using only a checkbook. This works fine for individuals managing their personal finances, but it just doesn’t cut it for businesses.

In double-entry bookkeeping, each time you perform an action that has a financial impact, a transaction is recorded. It’s called “double-entry” because each transaction is recorded in at least two accounts: a source account, or where the money comes from, and a destination account, or where the money goes. For an example, consider what happens when you write a check to purchase office supplies. The source of the funds is your business checking account. The destination account is the expense account you set up to track office supplies.

In computerized accounting, like WorkingPoint, you don’t have to record transactions directly into the ledger. Instead, you use specific forms, like Deposit, Invoice, and Bill, to record your business activity. But under the hood, credits and debits are still being recorded to keep the books in balance.