Closing the Books on 2009

Topic: Double-entry Bookkeeping | Comments (1)

With the new year just days away, you may be gathering your depreciation schedules and other adjusting entries to close your books, preparing to print your financial reports for the year, and getting ready for a new year of recordkeeping. WorkingPoint makes it easy to transition from one year to the next by providing you easy ways to record your adjustments as well as handling some of them for you!

If you just started your business or you’re new to accounting for your business records, I would be honored to walk you through closing your books at year-end, starting with a look at what is involved in keeping records for your business from a process standpoint.

What is the Accounting Cycle?

The accounting cycle is a series of steps that are taken to process your paperwork and generate meaningful financial reports. The accounting cycle is the same for every business. But you can determine the frequency of the cycle based on your business structure (sole proprietor, S-Corp, Corporation, etc.) and reporting period requirements. A reporting period is the date range that you want to report on. Standard reporting periods include month, quarter, and year. A lot of business owners want to see how their business is doing month-to-month, so their reporting period is month. For them, the accounting cycle starts at the beginning of the month and closes at the end of the month. Businesses that choose this frequency tend to have many transactions per day or month, want to keep a close eye on revenue and expenses, and don’t want to fall behind on data entry. If you are just starting out and don’t have a lot of transactions, you could start at a quarter reporting period and then, as your business grows, you could change it to month.

What steps are involved in the accounting cycle?

The accounting cycle includes a set of activities performed during the reporting period and another set of activities performed at the close of the reporting period.

During the reporting period:

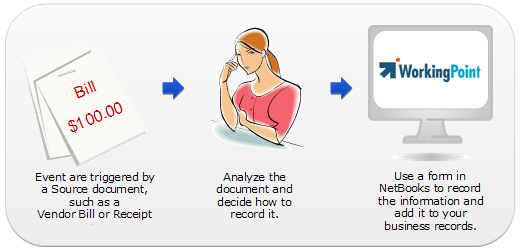

For every event that occurs that has a financial impact, a transaction needs to be recorded in WorkingPoint. The following steps should be taken each time a financial event occurs:

- Identify the event—This is often triggered by the receipt of a source document, such as vendor bill or receipt, or it could be the result of a phone call or other interaction that resulted in an event, like a sale you made over the phone.

- Analyze the transaction—Look at the document and gather the details including date, amounts, and accounts affected so you can determine what type of transaction it is (deposit, invoice, payment, etc.).

- Record the transaction—Using the event-specific forms in WorkingPoint or the adjusting entry form, record the transaction. WorkingPoint will update your accounts and the journal accordingly.

Repeat these steps as transactions occur. Keeping your records up-to-date will allow you to use helpful dashboards in WorkingPoint so you can see where your business is at a glance anytime and you won’t have to play catch up at the end of the month or year.

End of the reporting period

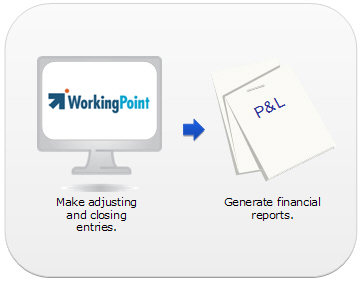

At end of the reporting period, perform the necessary closing activities, including:

- Making adjusting and closing entries—WorkingPoint performs some closing activities for you, like tracking your net income and transferring your retained earnings at year end. But there are other activities you might need to perform at the end of your reporting period, including posting depreciation and accruals (like prepaid expenses).

- Generating financial reports—WorkingPoint takes the hassle out of reporting by providing real-time, professional financial reports. You don’t have to transfer your business data to another system to generate reports. If you are incorporated, your financial statements are published for your shareholders, so it is important to practice regular closing activities and generate and distribute your reports. If you are a sole proprietor, you might only print these at year end for taxes.

So now that you are familiar with the process of recording your business activity, next time I’ll walk you through “End of the reporting period” activities that you will want to do as part of your year-end closing for 2009.

Pingback: Tweets that mention Closing the Books on 2009 | WorkingPoint -- Topsy.com()