Financial Reporting

Professional-looking, informative financial reporting is just a click away when you use WorkingPoint to manage your business. Attractively formatted and easy to read, WorkingPoint reports use the most widely accepted accounting practices to organize your financial data so you can make sense out of your business activities.

WorkingPoint includes the most insightful and necessary financial reports:

With all WorkingPoint reports, you can:

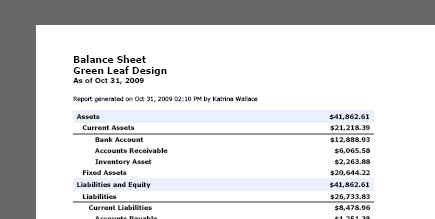

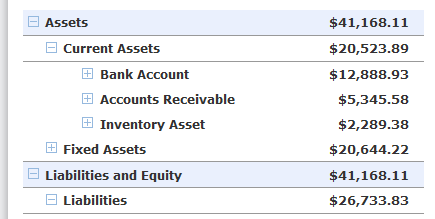

Balance Sheet

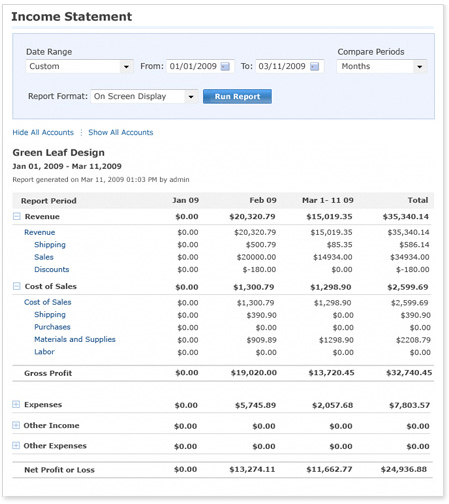

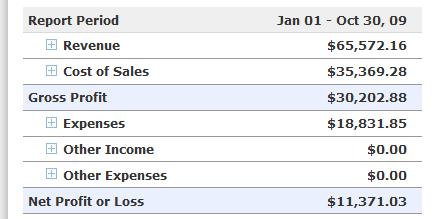

Income Statement, Profit and Loss

Many business owners use the Income Statement (Profit and Loss) to manage their business because it gives a clear view of what they are earning, what it costs to sell their goods and services and what they are spending. The Net Income line item at the bottom of the report tells you if you are making a profit (positive net income) or incurring a loss (negative net income). In addition to tracking profit, you can use the Income Statement (Profit and Loss) to spot trends in how your money is coming in, whether it is driven by season, product line or strategic marketing events and how your money is going out so you can budget for the future.

With WorkingPoint, we’ll provide you the most current view of your revenue, spending and profit via the Income Statement (Profit and Loss) and informative dashboard widgets, like our “Profit and Loss” widget.

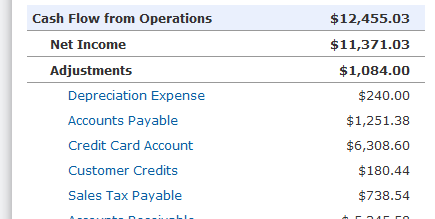

Cash Flow Statement

Customize Your Reports