Accounting

You don’t have to be an expert in accounting principles to manage your business finances like a professional. WorkingPoint’s online accounting makes double-entry accounting simple:

Not familiar with double-entry accounting? Learn how it works and why it is important for your business.

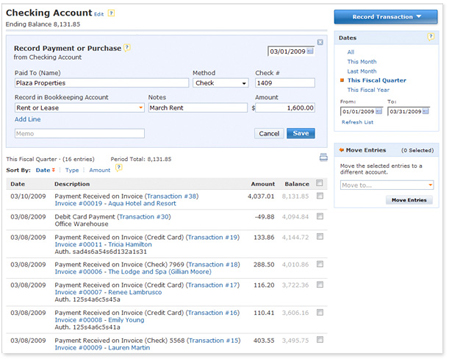

Record Accounting Transactions While Running Your Business

We haven’t met many business owners who spend much time thinking about debits and credits. They’re focused on the things they need to do every day to run their business: invoicing customers, getting paid, and paying their bills. When you use WorkingPoint to invoice a customer or record money coming in or out of your business you don’t have to worry about how any of it affects your books. Simply record your business activities via easy-to-complete forms, and WorkingPoint applies your debits and credits to the appropriate accounts for you. Double-entry accounting is happening without you having to think about it. That’s WorkingPoint online accounting!

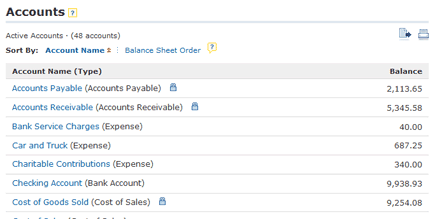

Categorize Business Transactions

Accountants and bookkeepers use what is sometimes referred to as a Chart of Accounts to categorize and track the financial transactions that result from running a business. WorkingPoint’s Account List gives you a logical, easy-to-understand set of accounts that help you keep track of what you owe, what you own, and the money you spend and receive. With WorkingPoint’s premium account plans, you can fully customize your list of accounts so that transactions are categorized in a way that makes the most sense for your business.

Manage Account Activity

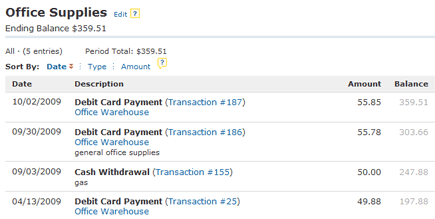

When you record money you’ve received or spent, WorkingPoint’s double-entry accounting system posts the activity to the appropriate accounts. For example, when you purchase office supplies using your checking account, the money you spent is moved out of your checking account and into the account you use to track expenses for your office supplies. This is recorded as an entry in each account.

WorkingPoint’s account activity lists give you user-friendly views of all the entries your accounts, so you can see at-a-glance how your money has moved between them. From these lists, you can also edit and delete entries or move them to other accounts.

WorkingPoint’s account activity lists give you user-friendly views of all the entries your accounts, so you can see at-a-glance how your money has moved between them. From these lists, you can also edit and delete entries or move them to other accounts.

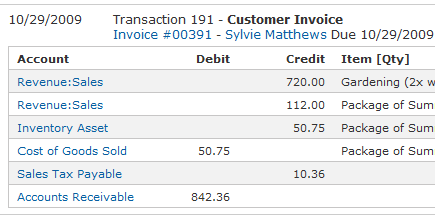

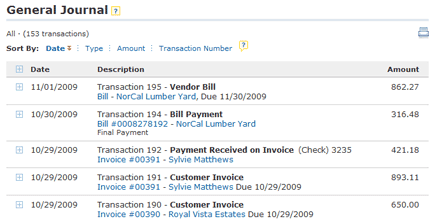

View a List of All Transactions

A full-featured, double-entry accounting system wouldn’t be complete without a General Journal. The General Journal shows you all of your transactions in chronological order. It lets you see all of your account activity in one place.

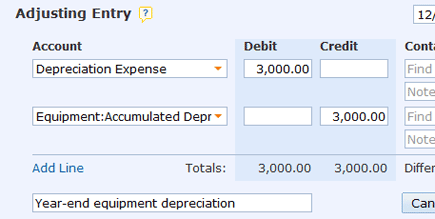

Perform Adjusting and Closing Activities

Financial reports cover a specific period of time, usually your fiscal quarter or year. Before sharing your final reports for a period, you’ll need to make any final adjustments to them and then “close” them. WorkingPoint performs some closing activities for you, like tracking your net income and transferring your retained earnings at year end. Other activities you need to perform at the end of your reporting period are easy to do in with WorkingPoint by creating Adjusting Entries.

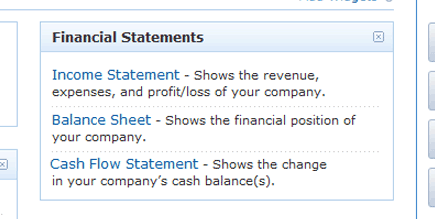

Analyze Finances through Key Financial Reports

While you’re running your business, WorkingPoint is keeping track of your business records so you can produce real-time, professional financial reports and see the how your business is doing at any given time. With WorkingPoint reporting, you can create standard financial reports including: a Balance Sheet to see your overall business position; an Income Statement to evaluate how much you are spending on expenses month-to-month; and a Cash Flow Statement for a given period so you can see how your cash is being used. Read more about WorkingPoint’s Financial Reports.